Contract Terms and Conditions: These Terms and Conditions apply only to the Health & Hospital Corporation (“HHC”) and the Marion County Public Health Department and its programs (“MCPHD”), regardless of funding source, including Grants.

Duties: Contractor duties outline the exact, detailed services to be performed. The duties can be set out in a Statement of Work in an attached exhibit.

Consideration: Consideration states a definite amount to be paid to a contractor in exchange for services. A not-to-exceed figure on total payment should be specified. Purchases of services must be accompanied by a service agreement.

Term: Term states duration of the contract by giving specific beginning and ending dates.

Assignment: Contractor shall not extend, assign, or subcontract the whole or any part of an agreement without HHC’s prior written consent. Contractor shall provide prompt written notice to HHC of any change in contractor’s legal name, legal status, or address so that the changes may be documented and payments to the successor entity may be made.

Audits: Contractor may be required to submit to an audit of funds paid through a contract. Contractor and its subcontractors, if any, shall maintain all books, documents, papers, accounting records, and other evidence pertaining to all costs incurred under a contract.

Conflict of Interest: No officer, employee, or agent of HHC or contractor or any other party who has any function or responsibility in connection with the planning or execution of a contract shall have any personal financial interest, direct or indirect, in a contract, or receive any benefit from it, other than regular employment or fees as agreed upon.

Debarment and Suspension: Contractor must agree that neither it nor its principals nor any of its subcontractors are presently debarred, suspended, proposed for debarment, declared ineligible or voluntarily excluded from entering into a contract by any federal agency or by any department, agency, or political subdivision of the State of Indiana.

Disputes: Should any disputes arise with respect to a contract, contractor and HHC agree to act immediately to resolve such disputes. Time is of the essence in the resolution of disputes. Contractor agrees that the existence of a dispute notwithstanding, it will continue without delay to carry out all its responsibilities under a contract that are not affected by the dispute. Should contractor fail to continue to perform its responsibilities regarding all non-disputed work, without delay, any additional costs incurred by HHC or contractor because of such failure to proceed shall be borne by contractor, and contractor shall make no claim against HHC for such costs. If the parties are unable to resolve a contract dispute between them after good faith attempts to do so, a dissatisfied party shall submit the dispute to the HHC Purchasing for resolution.

Employment Eligibility Verification: As required by IC 22-5-1.7, a contractor must swear or affirm under the penalties of perjury that contractor does not knowingly employ an unauthorized alien. If applicable, contractor must enroll in and verify the work eligibility status of all its newly hired employees through the E-Verify program as defined in IC 22-5-1.7-3.

Financial Reporting: Contractor shall be responsible for all financial record keeping and reporting as well as for any state, federal or local income tax reporting and payment, and any other tax-related reporting and payment, pertaining to income earned during the term of a contract.

Force Majeure: A contract party will not be liable for failure or delay in performing its obligations under a contract if such failure or delay results from any act of God, act of war, civil unrest, labor strike, riot, fire, flood, earthquake, epidemic, act of governmental authorities, or other cause beyond such party’s reasonable control (including any mechanical, electronic, or communications failure, but excluding failure caused by a party’s financial condition or negligence). If, due to Force Majeure, either party is rendered unable, wholly or in part, to carry out its obligations under a contract, then the party will give notice and complete details in writing to the other party within a reasonable time after occurrence.

Governing Law: Contracts shall be governed, construed, and enforced in accordance with the laws of the State of Indiana, without regard to its conflict of laws rules.

HIPAA Compliance: If a contract involves services, activities, or products subject to the Health Insurance Portability and Accountability Act of 1996 (HIPAA), contractor must agree to appropriately safeguard Protected Health Information (defined in 45 CFR 160.103), and shall comply with, the provisions of 45 CFR 164 regarding use and disclosure of protected health information.

Indemnification: Contractor must agree to indemnify, defend, and hold harmless HHC, its agents, officials, and employees from all third-party claims and suits including court costs, attorney’s fees, and other expenses caused by any act or omission of the contractor and its subcontractors, if any, in the performance of a contract.

Independent Contractor: Contractor performs as an independent entity under a contract. No part of a contract shall be construed to represent the creation of an employment, agency, partnership, or joint venture agreement between the parties. Neither party will assume liability for any injury (including death) to any persons, or damage to any property, arising out of the acts or omissions of the agents, employees, or subcontractors of the other party. Contractor understands and agrees that HHC will provide no employment-related benefits. Contractor shall have no claim against HHC for any social security, worker’s compensation, disability, unemployment, vacation, health benefits, or any other benefits.

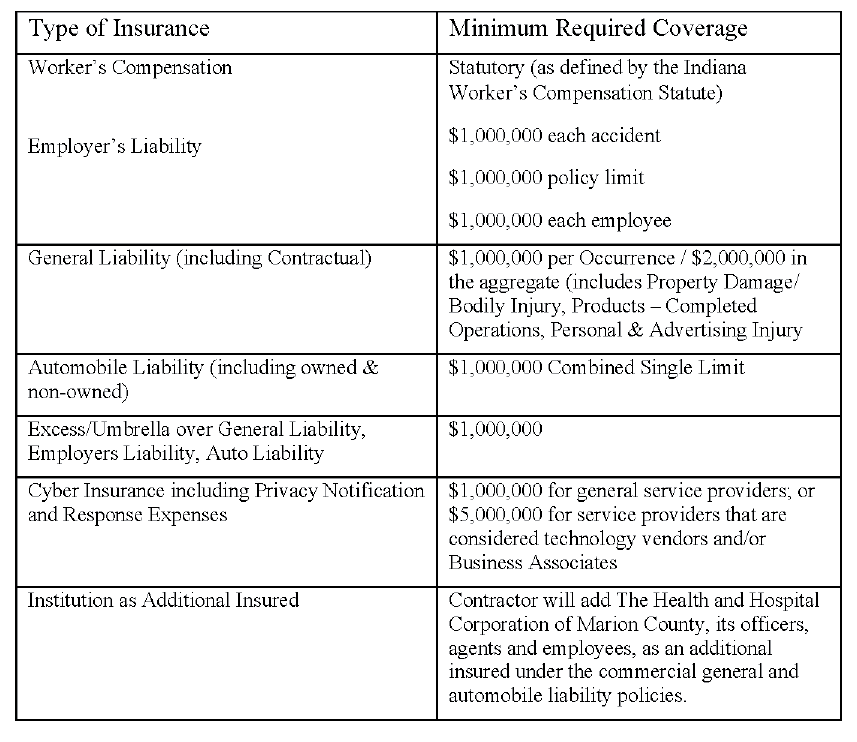

Insurance: Contractor and its subcontractors shall secure and keep in force during the term of a contract the following insurance coverages, if applicable, covering the contractor for any and all claims of any nature which may in any manner arise out of or result from contractor’s performance under a contract. HHC reserves the right to modify insurance coverage requirements based upon the nature of the services provided by contractor.

Contractor shall provide a certificate of insurance showing coverages, upon request.

HHC is a self-insured municipal corporation maintaining liability limits of $700,000 per person and $5,000,000 per occurrence in accordance with the liability limits in IC 34-13-3-4.

Licensing Standards: Contractor, its employees, and subcontractors shall comply with all applicable licensing standards, certification standards, accrediting standards and any other laws, rules, or regulations governing services to be provided by the contractor pursuant to a contract.

Minority, Women, Disabled or Veteran-Owned Business Participation: HHC seeks to utilize minority-owned business enterprises, women-owned business enterprises, disabled-owned business enterprises, and veteran-owned business enterprises for public works projects, as well as procurement of goods and services. If contract was procured pursuant to HHC’s bidding process or a request for proposal, contractor agrees to meet certain established goals with respect to minority, women, disabled and veteran-owned business participation. Contractor agrees to advise HHC, not less frequently than monthly, of the status of its compliance with applicable minority, women, disabled and veteran-owned business requirements and goal achievement. At a minimum, contractor shall identify the completion date and actual final dollar value of work completed pursuant to each minority, women, disabled and veteran-owned business subcontract.

For contracts not procured pursuant to HHC’s bidding process or request for proposal, HHC encourages its contractors to utilize minority, women, disabled or veteran-owned business enterprises as subcontractors in the performance of services, and to voluntarily report the use of and dollar amount paid to these subcontractors.

Nondiscrimination: Pursuant to the Indiana Civil Rights Law, specifically including IC 22-9-1-10, and in keeping with the purposes of the Civil Rights Act of 1964, the Age Discrimination in Employment Act, and the Americans with Disabilities Act, contractor must covenant that it shall not discriminate against any employee or applicant for employment relating to a contract with respect to the hire, tenure, terms, conditions or privileges of employment or any matter directly or indirectly related to employment, because of the employee’s or applicant’s race, color, national origin, religion, sex, age, disability, ancestry, status as a veteran, or any other characteristic protected by federal, state, or local law. Breach of this covenant may be regarded as a material breach of a contract.

Payment: Contractor shall submit invoices with the appropriate documentation to validate expenses associated with reimbursements. HHC has a right to retain final payments if professional services were not rendered in accordance with Agreement. The final claim shall be sent to HHC no later than 45 days after termination of an agreement. Late payments, if any, shall be determined and made in accordance with IC 5-17-5-1.

Tax Exempt Status: HHC is a tax-exempt municipal corporation and political subdivision.

Termination: A contract may be terminated by either party upon giving 30 days written notice to the other party. Upon receipt of a proper accounting of services rendered to the termination date, HHC shall be liable to pay for services rendered through that date. A contract may be terminated by HHC in the event of nonappropriation by its governing body.

Travel: No expenses for travel will be reimbursed unless specifically authorized by a contract.

Authorized travel costs are reimbursed as follows:

- Car Rental: Economy, shared car rental if more than one person contracted for services

- Mileage: Actual miles driven reimbursed at IRS published rates

- Airline: Coach

- Hotel, Per Diem: Reimbursed at GSA published rates

Prohibited Provisions: The following provisions are not allowed in a contract:

- Any provision requiring insurance coverage over HHC’s statutory limits, IC 34-13-3-4

- Any provision providing that contract be construed in accordance with laws other than Indiana

- Any provision providing that suit be brought in any state other than Indiana

- Any provision requiring payment of taxes by HHC

- Any provision requiring payment of penalties, liquidated damages, interest, or attorney’s fees by HHC

- Any provision modifying the applicable Indiana statutes of limitation

- Any provision relating to the time within which a claim must be made

- Any provision requiring payment of consideration in advance

- Any provision limiting disclosure of the contract in violation of the Access to Public Records Act, IC 5-14-3

- Any provision requiring payment in less than 35 days, IC 5-17-5-1

Prohibited Entities: Contracts with the following entities are prohibited:

- Suspended or debarred entity

- Entity with conflict-of-interest violation

- Person disqualified under IC 1-1-15

Quick Navigation